We are here to analyze the Asian Financial Crisis that took place in the year 1997. The crisis, which caused such a severe impact on some economies, that they have not been able to recover from it since. And we will also be discussing about the possibility of the similar crisis repeating in the near future.

The crisis came as a shock to authorities. Up until the banks began to go bankrupt, the crisis was unpredictable. World Bank’s 1993 Miracle Report named Thailand as the model for economic development. It came as a surprise to the very institution that is responsible to keep economic activities in check that Thailand would experience such a major downturn.

During the years 1985-1995, the tiger Economies consisting of the following countries: South Korea, Thailand, Malaysia, Indonesia, Singapore, and the Philippines, experienced sky rocketing growth rates, but experienced their stock market and currency lose their value. The Baht lost roughly 77% of the value at which it was prior to the de-pegging in July 2.

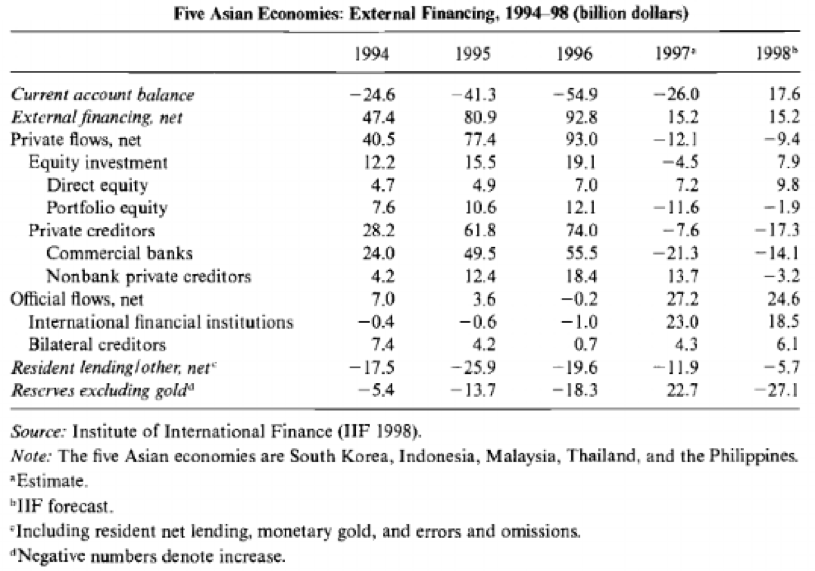

The effects of the crisis could be seen through the current account balance reversal that took place in 1997.

The current account balance indicates the expenditure as well as the revenue a country generates after transacting with the ROW (Rest of the World). When the current account balance of a country is positive, this means that country is a net lender to ROW, when it is negative it indicates that the country is a net borrower.

In the above case, Thailand was a net borrower until 1997. The current account deficit increased from 1994 to 1996, meaning that there was an increase in the foreign investments. These investments fell in the year 1996 and the current account balance shifted to surplus after the crisis. This indicated that the country had to pay back all the borrowings after the crisis.

The stock market fell at alarming rates, from 816.79 points on December 20, 1996 to 385.25 points on December 19, 1997. Dropping down to approximately half of its value. 56 out of a total of 89 finance companies closed down.

The following are the reasons, why the crisis happened in the first place.

The Asian Financial Crisis of 1997 was caused by and also took a huge a toll on a lot of parties, therefore it is better to understand the issue from its root.

The plausible groups that were at the root of this crisis were the Thai government, the international investors/speculators as well as the financial institutions.

It all started with the devaluation of the Baht (July 2,1997), it was caused due to the collapse of the fixed exchange rate, pegged to the US Dollar. Since, the speculative flow of Baht was so strong, the peg snapped.

The strong interlinkage of the relationship of government and the gave way for Crony Capitalism. It is a type of capitalism in which business thrives and revenues are generated due to the nexus of businessmen and politicians, corrupting the economic reforms.

In the first half of the 1990s, there was a huge boom in the investments that occurred in the Thai economy. A banking facility, BIBF (The Bangkok Banking Facility) was created to make it simpler for banks to get loans from foreign nations and afterward lend that money to those searching for it in Thailand.

Revelation of unsound debts

The financial institutions started lending out funds at a super-fast pace. The increase in lending caused a rapid short term growth in the economy, caused by the increase in the output and aggregate demand. But this initial economic growth masked the underlying debt. When the economic growth and productivity decreased, the causal factor being that the South East Asian nations had a huge number of banks as well as other companies that over extended the loan, with overestimated sources of revenue.

But when the market crumbled, the companies were drained because of the huge debt. This made the obligations too hard to even think about repaying.

This wrong implementation was aggravated by the fact that the Bank of Thailand guaranteed to pay back any institution if a run on the bank happened. Meaning a situation where people withdraw their money when they do not trust the functioning of the bank, leading to the bank’s solvency. This promise made due to the close ties of the banking institutions with the government.

This agreement was one of the major causes of downfall of Thailand. This agreement did lead to a short term economic growth as people started getting loans more easily. But since many of the businesses had returns that were over estimated by the banks. They started making defaults.

When the banks moved towards the Bank of Thailand for a bailout, due to the huge amount of defaults, the banks had to withdraw on their guarantee. Therefore, this caused the companies to declare bankruptcy. When the international investors noticed this, they panicked and withdrew their investments from the Thai economy. As the government had seized to back them up.

The property market

Almost all financial crisis is caused due to the property market, its boom and eventual bust. Property being the ultimate collateral, Banks give out loans on the basis of property as collateral. The banks might have given loans, say 10 years ago and within that time the land prices rose, at the time of default, the bank can acquire the property and sell it to recover the whole amount. Whereas when the property prices fall and they can fall 40-50% this leads to banks losing their money and causing an avalanche, a chain reaction.

The loans given had collateral as property, but when the businesses started defaulting, the collateral was occupied and sold, but due to the falling property rates, selling of the land did not cover the bank’s losses.

De pegging of the Baht

When the loan was borrowed internationally by the banks, it was borrowed in US Dollars. At that time the Baht was pegged to the US Dollar. But with a free floating Baht, when the time came to pay back the borrowed amount as well as the interest, the amount owed doubled and the number of institutions which defaulted, increased.

Solution

The solution that was taken out by the international organization IMF was to cut down the government spending and raise the interest rates, this would decrease the aggregate demand, therefore stabilizing the currency.

The Government which backed up all the Banking institutions had to do something, therefore they spent money, paying the institutions by their treasury. The cost which the tax payer has to bear eventually.

Low deposit rates, meaning that return on investment offered by the banks would be lowered for the banks to recover in the long term, eventually coming as intrinsic cost for the general public.

The Extradition Bill: A crisis for Hong Kong

The introductory events of market collapse was the piling up of economic weakness across the Asian economies, which operated largely on the investments financed by international loans in foreign currencies, mainly the US Dollar.

The 1997 crisis spread in the Asian market, reaching Hong Kong’s economy eventually. Hong Kong’s economy survived due to the drastic measures taken by the authorities. They bought equities and skyrocketed the interest rates. This safeguarded the dollar peg in the country.

The highly unpopular and debated bill of the extradition treaty of Hong Kong and Mainland China, if passed can lay a foundation for a financial crisis to happen. In essence causing 1997 all over again. This bill is highly criticized by both the citizens of the country as well a many countries in the West.

Right now Hong Kong is abiding by the principles of “one country, two systems”, wherein which in 1997 British signed a treaty with China stating that they would peacefully hand over Hong Kong to China on one condition that for 50 years Hong Kong will retain its economic, social, legal as well as political autonomy and will exercise freedom of speech, freedom of expression, freedom of press, freedom of religious worship, basically all the fundamental freedoms and that China would have no influence in Hong Kong’s decision making.

Under the British rule Hong Kong’s economy boomed and even after the signing of the agreement, Hong Kong being an autonomous state now has a special status, and is still ranking number one as the Worlds freest economy, while China is in the hundreds.

If the treaty gets signed, Hong Kong’s borders with China will erase going by the US-Hong Kong Policy Act of 1992, US can revoke Hong Kong’s beneficial/special status.

It can lose the majority of its enrollments to worldwide associations as well as the favorable duties and other conditions enjoyed by Hong Kong.

If Hong Kong becomes a part of Mainland China and agrees to its conditions, it will lose its special status, it will reduce the confidence of all the multinational corporations, international schools, expatriates. They would liquefy their assets and convert them into safer currencies like the US Dollar. They’ll start disinvesting in the Hong Kong economy, causing a reversal in the current account balance.

Causing a financial crisis altogether.